In 2009, he sells the remainder of the parts for $180. He sells parts for $80 that he bought for $30, and has $70 worth of parts left. A business that produces or buys goods to sell must keep track of inventories of goods under all accounting and income tax rules. Inventories have a significant effect on profits. The cost of storing products the business sells.The direct labor costs of workers who produce the products.The cost of products or raw materials, including freight or shipping charges.Expenses that are included in COGS cannot be deducted again as a business expense. Alternative systems may be used in some countries, such as last-in-first-out (LIFO), gross profit method, retail method, or a combinations of these.Ĭost of goods sold may be the same or different for accounting and tax purposes, depending on the rules of the particular jurisdiction. This may be done using an identification convention, such as specific identification of the goods, first-in-first-out (FIFO), or average cost. When multiple goods are bought or made, it may be necessary to identify which costs relate to which particular goods sold. Among the potential adjustments are decline in value of the goods (i.e., lower market value than cost), obsolescence, damage, etc. Ĭost of goods sold may also reflect adjustments. Principles for determining costs may be easily stated, but application in practice is often difficult due to a variety of considerations in the allocation of costs. Such modification costs include labor, supplies or additional material, supervision, quality control, and use of equipment. In addition, if the goods are modified, the business must determine the costs incurred in modifying the goods. ĭetermining costs requires keeping records of goods or materials purchased and any discounts on such purchase. These costs are treated as an expense in the period the business recognizes income from sale of the goods. When the goods are bought or produced, the costs associated with such goods are capitalized as part of inventory (or stock) of goods.

Many businesses sell goods that they have bought or produced.

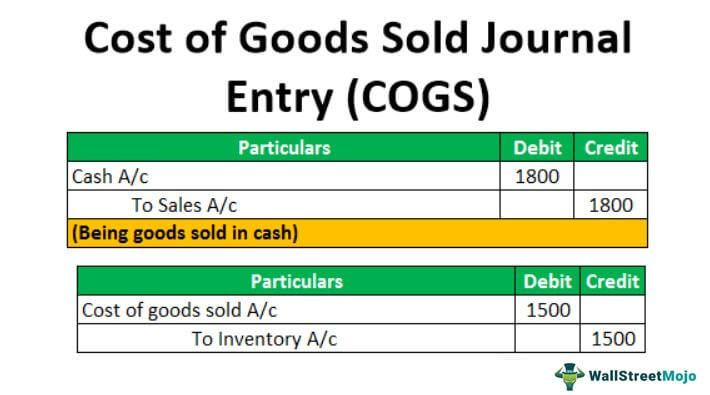

The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value. Costs of goods made by the businesses include material, labor, and allocated overhead. Costs include all costs of purchase, costs of conversion and other costs that are incurred in bringing the inventories to their present location and condition. Cost of goods sold ( COGS) is the carrying value of goods sold during a particular period.Ĭosts are associated with particular goods using one of the several formulas, including specific identification, first-in first-out (FIFO), or average cost.

0 kommentar(er)

0 kommentar(er)